maryland ev tax credit form

Tax credits depend on the size of the vehicle and the capacity of its battery. Box 49005 Baltimore MD.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Marylanders who purchased a plug-in electric vehicle since funds were.

. Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year. Maryland Ev Tax Credit Form. The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income.

Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive. Electronic Funds Transfer Program PO. See above To claim the credit you must complete Part B of.

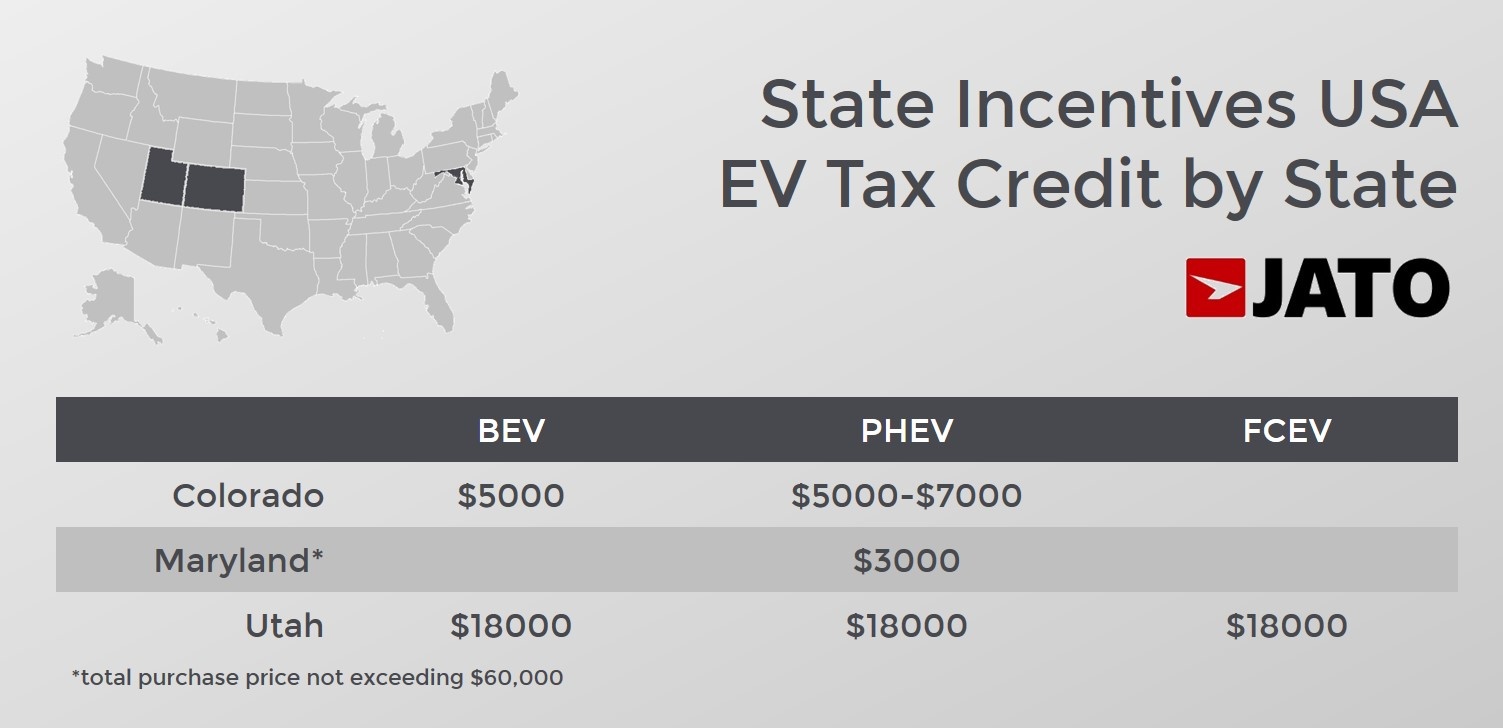

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service. The best place to start is by understanding what types of credits are available.

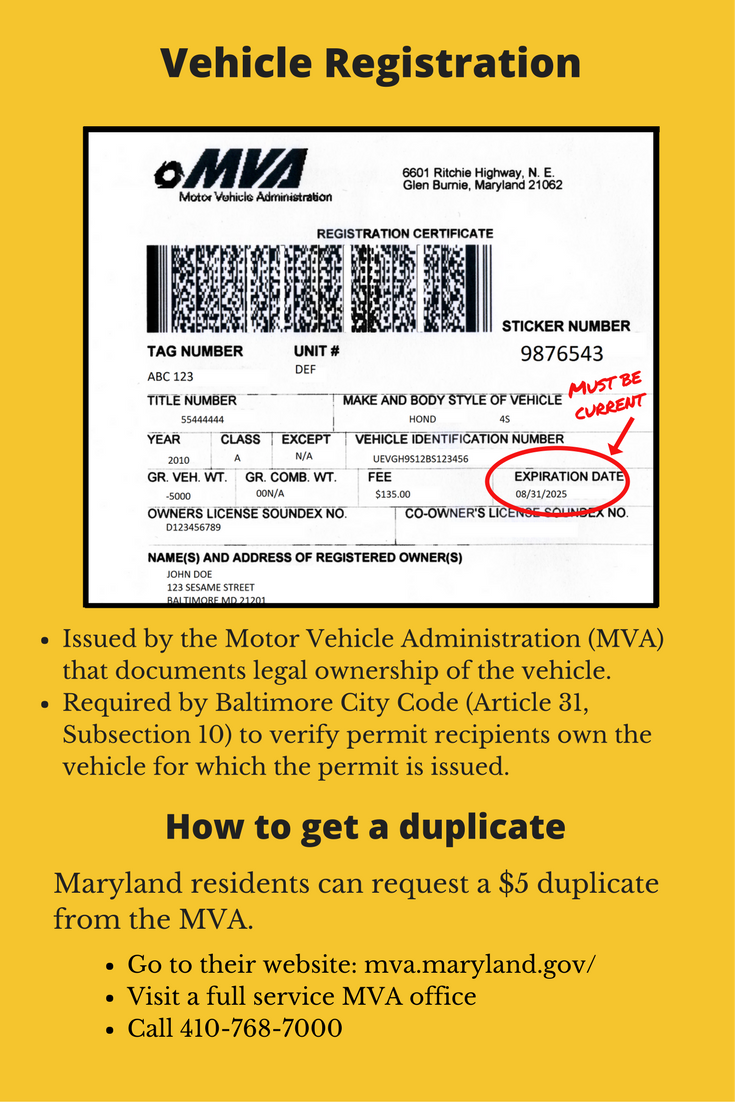

The tax credit is available for all electric vehicles. You must report the credit on Maryland Form 502 505 or 515. Please do not email any tax credit applications or.

If you have purchased a zero-emission plug-in electric or fuel cell electric vehicle from a Maryland dealer the dealer will assist you with completing the proper form for the tax credit. January 5 2021 by Lanny. Maryland EV Tax Credit Extension Proposed in Clean Cars Act of 2021.

EV Tax Credits By Barry Boggs Jr. State Department of Assessments Taxation Homeowners Tax Credit Program PO. Instructions on How to Fill Out Application Using Adobe Fill and Sign.

A whopping 90 of the energy consumed from transportation in the us comes from petroleum. For more general program information. Please Fill Out Form Electronically Print Sign and Return to MEA.

MARYLAND FORM 502CR INCOME TAX CREDITS FOR INDIVIDUALS Attach to your tax return. This credit is in addition to the subtraction modification available on the Maryland return for child and dependent care expenses. FY23 EVSE Commercial Rebate Application Form.

I solemnly affirm under penalties of law including those set forth in Maryland Code Section 9-20B-11 of the State Government Article that to the best of my knowledge the charging station. About Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit. Electric car buyers can receive a federal tax credit worth 2500 to 7500.

For every new ev purchased for use in the. COMRAD-012 2021 Page 3 NAME SSN PART G - VENISON DONATION - FEED THE. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid.

Opinion This Federal Bill Is Going To Supercharge Maryland S Energy Transition Maryland Matters

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Maryland State And Federal Tax Credits For Electric Vehicles In Capitol Heights Md Pohanka Honda In Capitol Heights

Rebates And Tax Credits For Electric Vehicle Charging Stations

Maryland Energy Administration

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Hyundai Of Capitol Heights

Tax Year 2022 Calculator Estimate Your Refund And Taxes

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Hyundai Of Capitol Heights

Claiming The 7 500 Electric Vehicle Tax Credit A Step By Step Guide

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Volkswagen

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland S Electric Vehicle Rebate Is So Popular It Ran Out Of Money Even Before The Fiscal Year Began July 1 Baltimore Sun

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Electric Vehicle Solar Incentives Tesla

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

How To Claim Your Federal Tax Credit For Home Charging Chargepoint