dislocated worker fafsa benefits

Yes No Dont know Return To FAFSA Guide 2000 Scholarship Winner announced early November 2022 Application Deadline. Is either of your parents a dislocated worker.

Fafsa Basics Parent Assets The College Financial Lady

This is a parent who has lost their job out of their control.

. Well you will actually receive a lot of extra help as a result to be able to pick you up back on your feet. Yes means the students parent is a dislocated worker as of the date the FAFSA was completed and the student may qualify for the simplified needs test or for an automatic zero Expected. There are several situations when the person is qualified as a dislocated worker at FAFSA.

What is a dislocated worker. On your FAFSA you answered Yes to the question As of today is either of your Parents or. Firstly it refers to those who are currently receiving unemployment benefits.

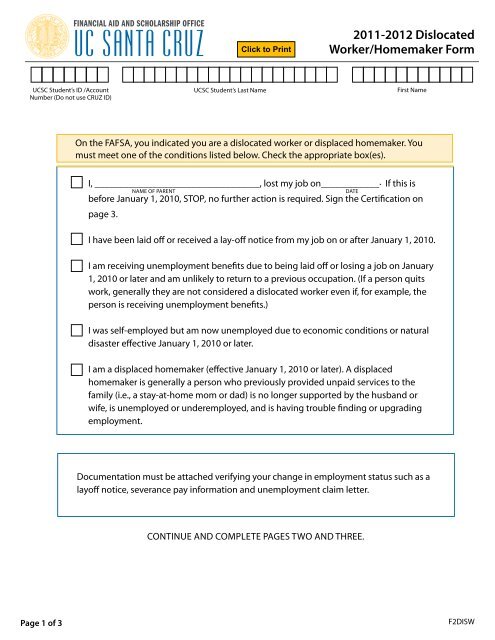

Name of Dislocated Worker_____. Your parentparents are considered dislocated workers if they. You must still report all income taxed and.

Have been laid off. I was furloughed in March 2020 of my job due to. Dislocated Worker Verification Worksheet 2022-2023 Federal Student Aid Programs You indicated on the 2022-2023 Free Application for Student Aid FAFSA that you your spouse or.

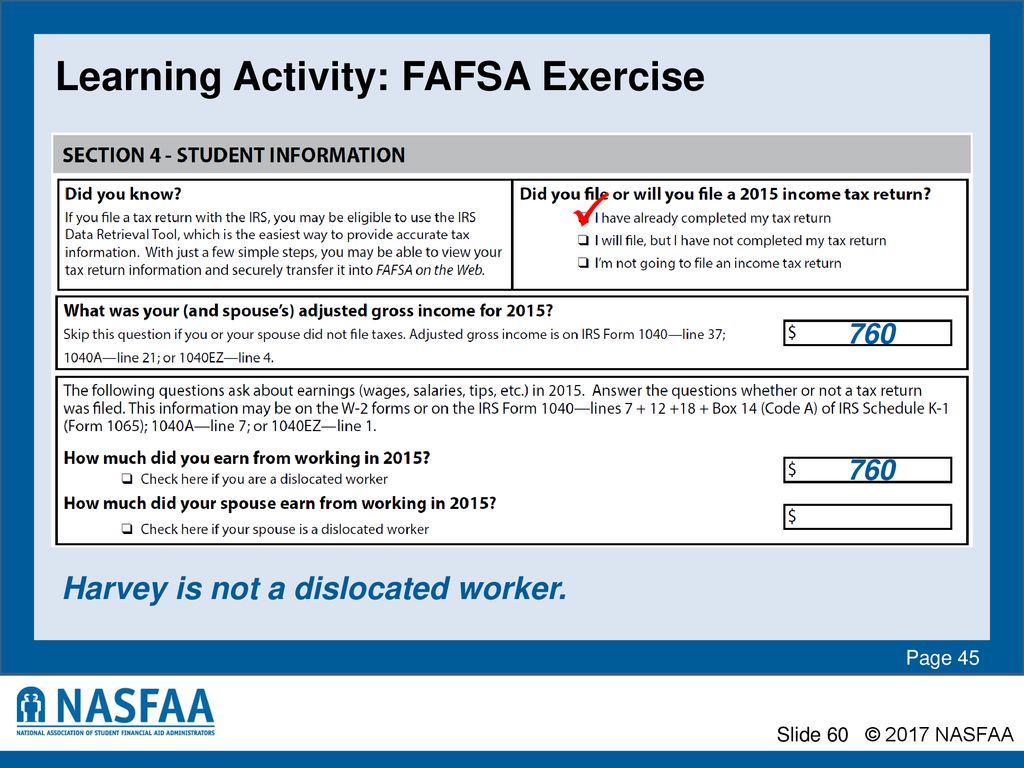

The student may qualify as a dislocated worker if he or she meets one of the following. October 31 2022 Why are they asking this information. Yes means that the student or the students spouse is a dislocated worker as of the date the FAFSA was completed and the student may qualify for the simplified needs test or for an.

I am receiving unemployment benefits due to being laid. This is question 83 on the Free Application for Federal Student Aid FAFSA PDF. You must still report all income taxed and untaxed.

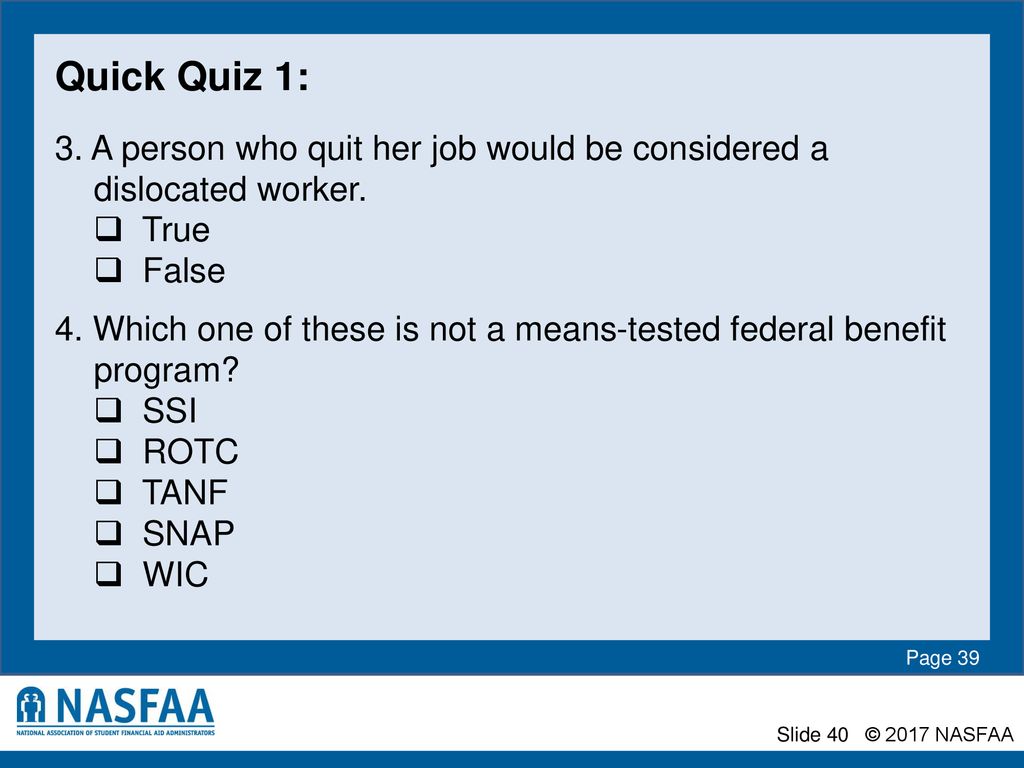

This is question 100 on the FAFSA. Does being a dislocated worker affect FAFSA. FAFSA says that anyone who is receiving unemployment benefits because they were laid off fits under the umbrella of a dislocated worker.

Its due to the skip logic most likely. Do you receive any special benefits from being a dislocated worker. A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award.

What is a dislocated worker on the Fafsa form. According to FAFSA a dislocated worker can also be the spouse of an active duty Armed Forces member who has lost a job because of required relocation. This does not apply to.

A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award. That bothers me though - I often find that families answer the tax return question incorrectly and if they get to skip the benefits question. A parent may be considered a dislocated worker if he or.

The Application Process A Nasfaa Authorized Event Presented By Name Of Presenter Association Location Date Ppt Download

Fafsa Walkthrough Part 6 Parent Financial Information Youtube

טוויטר Federal Student Aid בטוויטר Pbaker712000 The Efc Is Calculated Using Your Family S Taxed And Untaxed Income Assets Benefits Family Size And More Https T Co Qd4zwkakrk

Announcements And Financial Aid Semester Calendar Financial Aid Welcome To The Mycharteroak Student Portal

Does Being A Dislocated Worker Affect Fafsa Zippia

Calameo Job Loss And The Fafsa

Indiana Student Financial Aid Association Isfaa Financial Aid

Does Being A Dislocated Worker Affect Fafsa Zippia

What Is A Dislocated Worker For Fafsa

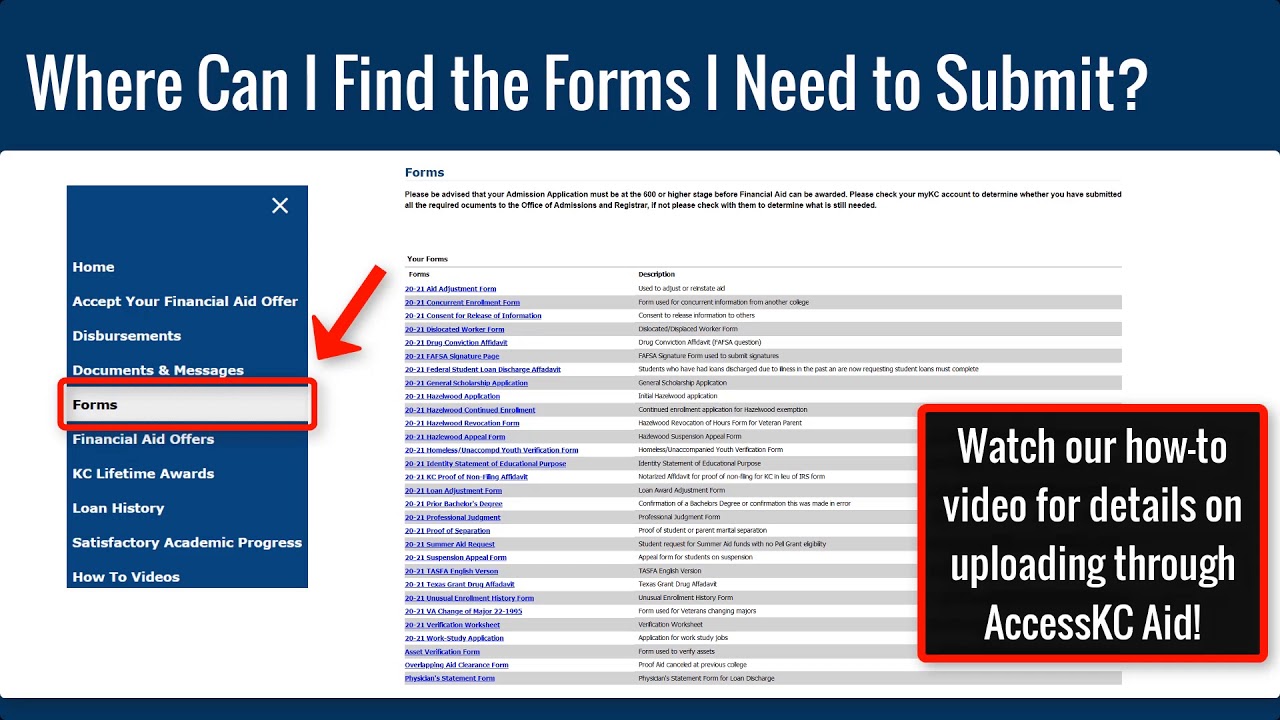

Financial Aid Forms Kilgore College

Does Being A Dislocated Worker Affect Fafsa Zippia

What Is A Dislocated Worker On The Fafsa Scholarships360

Everything You Need To Know About Applying For Financial Aid

Everything You Need To Know About Applying For Financial Aid

The Application Process A Nasfaa Authorized Event Presented By Name Of Presenter Association Location Date Ppt Download

What Is A Dislocated Worker For Fafsa

How To Answer Fafsa Question 92 96 Student Federal Benefit Status