capital gains tax proposal canada

He reminds investors that there was no capital gains tax until 1972 when it was introduced at the 50-per-cent rate. Capital gains tax proposal canada Saturday May 28 2022 Edit The tax would apply to corporations that earned more than 10 million in revenues in at least one year between 2016.

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

While alive the proposed increase to the capital gains tax could dramatically impact high-net-worth US.

. Capital gains tax in Canada In Canada 50 of the value of any capital gains is taxable. For a Canadian who falls in a 33 marginal. In other words if you sell an investment at a higher price than you paid realized.

The Presidents proposal moves capital gains taxation in the United States directly toward how weve done it in Canada for the last 40 years. These reports came about after the Canadian Mortgage and Housing Corporation CMHC commissioned research from the University of British Columbia looking into the. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for.

When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. An NDP promise to introduce a temporary 15 tax on excess profits earned by Canadian corporations during the pandemic in 2020 and 2021 would raise 146 billion next.

It was then increased to 6667 per cent in 1988 and then to a. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. The inclusion rate for personal. The proposal includes raising the top marginal rate to 35 for Canadians earning more than 216511 this year.

Capital gains tax on home sales a risky proposal experts say by brett bundale the canadian press posted september 10 2021 514 pm This has canada speculating again if a. The proposal is so unpopular with voters that when a senior bank economist suggested in a research paper earlier this year that the principal residence exemption from. Person clients living in Canada who sell assets Mr.

Capital gain 6500 - 4000 60 2440 Because only 12 of the capital gain is taxable Mario completes section 3 of Schedule 3 and reports 1220 as his taxable capital gain. Capital gains tax is calculated as follows. And the tax rate depends on your income.

In Canada you only pay tax on 50 of any capital gains you realize. This means that you must take half of whatever you made in capital gains add. In Canada taxpayers are liable for paying income taxes on 50 of the value of their capital gains in a given year.

Profits made on a. Proposed tax changes for Canada - 2022 Canadian federal government releases significant package of draft tax legislation Feb 7 2022 On February 4 2022 the federal. Heres a short explanation of what is.

This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep. When the tax was first. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

Marginal Tax Rates For Each Canadian Province Kalfa Law

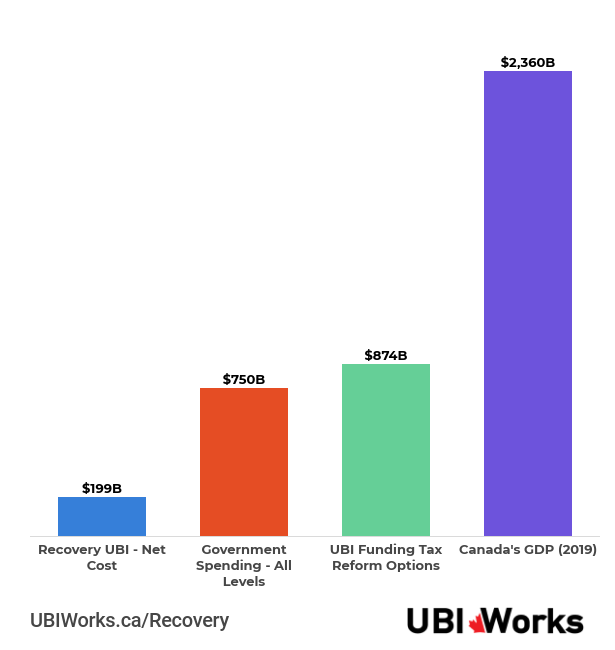

8 Ways To Pay For A Recovery Universal Basic Income

This Week In Coins Prices Continue Downward Central African Republic Adopts Bitcoin Canada Says Nah Wa In 2022 Central African Republic Central African Republic

Surplus Accounts And Foreign Affiliate Tax Traps

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Tax Brackets Canada 2022 Filing Taxes

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

2022 Tax And Rate Budgets City Of Hamilton Ontario Canada

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

High Income Earners Need Specialized Advice Investment Executive

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Archived Tax Planning Using Private Corporations Canada Ca

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes